Past, present, and future of spin-offs on the JSE

Disclaimer: This note is provided for general informational purposes only and should not be construed as financial advice. While all information is believed to be accurate, it is not guaranteed. All opinions and estimates expressed in this report reflect Urquhart Partners’ judgment as of the date of publication and are subject to change without notice. Urquhart Partners may have positions in the securities mentioned in this report. The reader assumes full responsibility for their interpretation and utilisation of any information included herein. Past performance is not indicative of future results.

Spin-offs have been a lucrative area of the market to invest in globally. But has this trend extended to the Johannesburg Stock Exchange (JSE)? We explore the distinct factors influencing spin-offs, analyse the historical performance of these companies on the JSE, and consider potential future developments in this niche area.

Foreword

Spin-off securities fall into the larger stable of special situation investments. To paraphrase Blackrock, special situations (otherwise known as workouts, event driven investments, or a host of other names) are companies that are undergoing a material change. These changes include mergers, spin-offs, restructurings, and management changes. Special situations are generally less influenced by broader stock market movements and are more dependent on the outcome of a specific event.

There has been a notable increase in the occurrence of special situations on the JSE. The challenging local operating environment and low equity valuations have resulted in a deluge of delistings, asset sales, liquidations, holding companies unlocking value, investor activism, distressed situations, as well as the creation of a few esoteric securities.

Spin-offs differ significantly from regular unbundlings and Initial Public Offerings (IPOs). Both unbundlings and spin-offs involve a parent company distributing shares in another company to its shareholders, however a spin-off results in the shares of a company that was not already listed being distributed. This distinction is crucial. Newly listed companies have many more unknowns compared to existing listed companies which have established shareholder bases, proven histories, known market valuations etc. This uncertainty often results in lower initial valuations that can lead to increased future performance.

Similar to spin-offs, IPOs also result in new companies being listed. The main difference between an IPO and a spin-off is that only those that want shares in a new listing subscribe to its IPO, while all of the existing shareholders of a parent company indiscriminately receive shares in a spin-off. This makes a spin-off a somewhat inefficient mechanism and usually leads to some initial selling pressure as the spin-off’s shareholder base adjusts. IPOs usually result in fresh capital being raised, either for the exiting shareholders or for the company itself. IPO’s are thus typically done for more popular companies which command higher valuations. Spin-offs are often done for less popular subsidiaries, sometimes as the subsidiary could not have been disposed of otherwise. This also contributes to spin-offs frequently having a lower starting valuation and often achieving higher subsequent returns.

A spin-off can be combined with an IPO, but the vast majority of the spin-off’s shares still usually end up in the hands of the parent company’s shareholders.

Are spin-offs worth investigating? Do not take it from us, this is what three industry titans have said on the topic:

“Well, we have a habit of looking at spinoffs. That’s been a core investment strategy for us for many, many, many years. We have probably invested in 50 or 60 of them. And it’s actually the highest-returning strategy we have within our portfolio. Our IRR on spinoffs is probably somewhere approaching 50 percent. And so we can identify only a few each year where we think they’re really misunderstood, they’re really misvalued. It’s hard because there’s large disclosure that people don’t want to bother to read, and people often don’t like it because they like the other part of the business. And so you get like a new shareholder base. And, sometimes, you just get a really attractive entry price.”

- David Einhorn, CNBC

"One study completed at Penn State, covering a twenty-five year period ending in 1988, found that stocks of spin-off companies outperformed their industry peers and the S&P500 by about 10% per year in their first three years of independence. The parent companies also managed to do pretty well – outperforming the companies in their industry by more than 6% annually during the same three-year period. These extra spin-off profits are practically built into the system. The spin-off process is a fundamentally inefficient method of distributing stock to the wrong people.”

- Joel Greenblatt, You Can Be a Stock Market Genius

“Many parent-company shareholders receiving shares in a spinoff choose to sell quickly, often for the same reasons that the parent company divested itself of the subsidiary in the first place. Shareholders receiving the spinoff shares will find still other reasons to sell: they may know little or nothing about the business that was spun off and find it easier to sell than to learn; large institutional investors may deem the newly created entity too small to bother with; and index funds will sell regardless of price if the spinoff is not a member of their assigned index.

For reasons such as these, not to mention the fact that spinoffs frequently go unnoticed by most investors, spinoff shares are likely to initially trade at depressed prices, making them of special interest to value investors. Moreover, unlike most other securities, when shares of a spinoff are being dumped on the market, it is not because the sellers know more than the buyers. In fact, it is fairly clear that they know a lot less.”

– Seth Klarman, Margin of Safety

PAST

An uncommon occurrence on the JSE

Spin-offs are a relatively rare occurrence on the JSE, although there has been a steady stream of these over time. In the dozen or so years since markets stabilized after the financial crisis, there have been twenty-five identified spin-offs on the JSE (excluding WeBuyCars and Rainbow Chicken in 2024). Last year was the only year since 2011 without any spin-offs on the JSE.

It is important to acknowledge this small sample size when considering the subsequent analysis. Despite examining these twenty-five spin-offs, as well as the associated parent companies, over several timeframes, the results are disproportionately influenced by outliers - some of which are extremely significant.

Historical performance

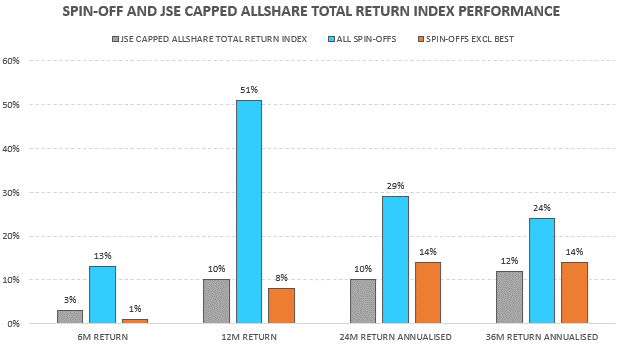

As a group, spin-offs on the JSE have historically significantly outperformed the index over six, twelve, twenty-four, and thirty-six months following being spun off. However, notable outliers largely drive this performance, particularly Thungela (+300% over six months, + >1,100% over one year, and + >900% over two years) and Montauk (+ >900% over three years). These outliers certainly underscore the potential within this niche of the stock market.

When these outliers are excluded from the impacted period, the pool of spin-offs underperforms the index in the short-term, likely due to selling pressure. It takes time for the now emboldened (and usually better incentivised) management teams’ actions to make an impact, and for the market to recognise the mispricing. This seems to lead to outperformance over two and three-year horizons, albeit by a much-reduced margin.

The returns for the spin-offs have been calculated based on the closing price from the first day of listing. Initial illiquidity in some of the spin-offs caused dramatic share price movements in the first few days, significantly affecting the calculated results. For example, Niveus fell by a whopping 62% on its second day as a listed company, while Montauk dropped by 44%. Conversely, Thungela rose by 32% on its second day. Recalculating the returns for the spin-offs from the second day’s closing price, and excluding the outliers, shows that the group would have outperformed the index by 6% over six months, 8% over a year, 13% annualised over two years, and 6% annualised over three years. We will update the performance figures in 2025 and are considering ways to refine the calculation methodology. Further details on the methods that were used are provided in the postscript.

The group of parent companies outperformed the market ahead of the spin-off, but subsequently underperformed the index. It is difficult to establish why this has been the case. One broad potential explanation could be that lower initial valuations for the parent companies may have spurred the firms to make shareholder-friendly decisions, including to spin out a subsidiary. These actions unlocked value and the companies re-rate. This resulted in the initial outperformance but reduced future returns.

Across none of the examined timeframes did the majority of spin-offs and parent companies outperform the index. This illustrates how the large winners in the sample drive the whole group’s outperformance and underscores the importance of selective stock picking in this area.

Over a quarter of the spin-offs with three years of available data more than doubled in value during that period (Bytes, South32, Montauk, Sibanye, Mpact and Rand Merchant Insurance), while only one spin-off (Stadio) experienced a decline of more than half its initial value over the same timeframe.

Size matters

Spin-offs typically are a small component of the previously combined group, with nearly three-quarters comprising less than 30% of the prior group. Bytes, Motus, Hosken Passenger Logistics and Rail, and Bidcorp were actually the larger constituents of the previously combined groups. Some of these situations may then be more accurately considered reverse spin-offs.

In terms of absolute size, it follows that generally smaller companies are spun off. Spin-offs on the JSE have most frequently fallen into the R1bn - R5bn market capitalization range. South32 was the largest spin-off, and it had a market capitalization of ~R110bn. The parent companies are usually larger, including behemoths such as Naspers and BHP.

Extra caution is necessary when stratifying a small sample size. Analysis of spin-off performance by initial market capitalization did not reveal a clear trend. However, analysing the parent companies revealed that larger parent companies generally outperformed the smaller ones, even producing positive returns relative to the index post spin-off.

What is also evident, however, is that spin-offs which were a smaller portion of the prior group significantly outperformed those which constituted a larger portion. This trend persisted even after adjusting for the large outliers, all of which were a smaller portion of the previously combined groups. This could potentially be because these companies would have been more likely to experience heavier selling pressure after being spun off, and may not have received sufficient management attention previously due to having been a smaller part of the formerly combined group.

Structural complexity

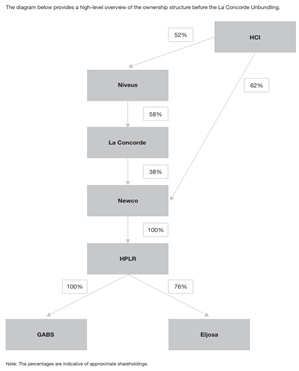

Spin-offs on the JSE have usually been structured as vanilla spin-off transactions. Only the Quilter, Ninety One and Bytes spin-offs incorporated IPO capital raises as well. This was partially to establish the company’s shareholder base as these companies also listed on the London Stock Exchange. Spin-offs from the broader HCI group have often been more intricate. A notable example is the complex spin-off of Hosken Passenger Logistics and Rail. This was illustrated in the circular at the time as such:

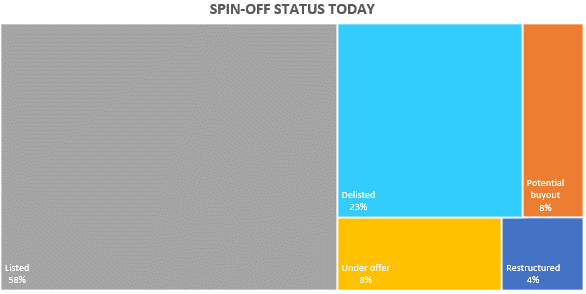

It is worth highlighting that spin-offs often precede further corporate activity. A streamlined corporate structure can reduce transaction risks, simplify integration processes, and enhance strategic alignment for potential acquirers. A full half of the parent companies and over 40% of the spin-offs have subsequently undergone further significant restructurings, been bought out, or attracted potential suitors.

PRESENT

The outlook for new spin-offs on the JSE seems promising. Already this year has seen WeBuyCars being spun out of Transaction Capital, as well as Rainbow Chicken being spun out of RCL Foods. Additionally, Anglo American has committed to either selling or demerging De Beers, while Glencore is considering spinning off its coal business. Compared to recent activity levels, the spin-off market is almost frothy.

While over a very short period, the spin-offs and parent companies of the ’24 vintage have followed historical performance trends. The new spin-offs have performed well, while the parent companies have exhibited weaker post spin-off returns thus far. Nonetheless, the parent companies produced strong returns from the spin-off announcement dates.

Looking further back, RCL Foods outperformed the index ahead of the Rainbow Chicken spin-off: +44% over six months, +21% over one year, and +5% over two years. The picture for Transaction Capital is more mixed. It outperformed the index by more than 120% over the six months preceding the WeBuyCars spin-off, but lagged the index by 26% over one year and 88% over two years before the spin-off.

FUTURE

We can only speculate what lies ahead for spin-offs on the JSE. A separation of Sasol’s local and international businesses could be achieved in this manner in the future. Holding companies are a fertile ground for future spin-offs, and there are possibilities in the Naspers/Prosus stable, or even at a company such as Growthpoint, to unlock value for shareholders by spinning off underlying businesses.

And then there is the king of spin-offs on the JSE.

The broader HCI group has been the most prolific practitioner of spin-offs on the JSE post the financial crisis. The larger Remgro group, through Grindrod Shipping, Rand Merchant Insurance, and Rainbow Chicken this year, as well as the extended PSG group, via Stadio and Quantum Foods, are the only other companies to have participated in more than one spin-off during this period. It is unsurprising that the management teams of these organisations have been lauded for their capital allocation.

Could there be more to come from HCI? Its subsidiaries have been streamlined, but possibilities still exist within the organisation. Impact Oil and Gas stands out as a potential spin-off candidate. There is also a substantial property portfolio across the group. Finally, could HCI also potentially join the global trend of spinning off coal assets? We will have to see what future holds.

Conclusion

Spin-offs have been a lucrative area of the market to invest in globally. This trend extends to the JSE, where there has been a limited, but steady flow of spin-offs over time. Due to the local investment climate, the supply of new spin-offs on the JSE can be reasonably expected to continue in the medium-term. Local spin-offs have historically outperformed the index, although this has been heavily influenced by a few exceptional cases. Spin-offs that constituted a smaller proportion of the previously combined group have performed especially well. Returns from parent companies have historically exceeded that of the index prior to a spin-off, but not afterward. Successful exploitation of this niche hinges significantly on effective stock selection.

Postscript

We extend our gratitude to everyone who contributed to this project. This is the first of a series of articles that will delve into different types of special situations investments on the JSE. Future articles will cover delistings, activist situations, and analyse the performance of IPOs on the JSE. Follow @UrquhartPartner on Twitter to promptly receive our next informative note about special situation investing on the JSE.

Methodology

One of the reasons why Urquhart Partners is releasing this informative note is to improve our understanding of spin-offs. It is important to clarify that not all the companies that we reviewed met our criteria for spin-offs. For instance, Curro was initially listed by induction, and then unbundled two months later by Paladin ahead of its delisting. This does not qualify as a spin-off under our definition. Similarly, eXtract emerged from the assets that enX did not acquire from Eqstra and was substantially unbundled to enX shareholders after enX converted its loans to eXtract into equity. Novus was initially listed by Naspers before being unbundled, while Woodside Petroleum was unbundled from BHP and is not listed on the JSE. Both of these also fall outside our definition of a spin-off.

This research was an iterative learning process. While many errors were rectified, some certainly have persisted. Total return figures are from Bloomberg, except for KWV which was manually calculated assuming no reinvestment. This seems accurate considering KWV’s lack of liquidity. Bloomberg data was adjusted for complexities where necessary e.g. the Bloomberg total return figures for Altron do not adjust for the Bytes spin-off. The data around Niveus spinning off Hosken Passenger and Rail also needed attention. Total returns numbers for parent companies were calculated up to the last day to trade ahead of the spin-off or from the ex-date. The return on the ex-date was therefore excluded to prevent inaccurate total return calculations related to the spin-off. The analysis required the whole period’s data to be available for each measurement period that was included, which slightly penalised the returns for spin-offs and parent companies due to intra-period delistings. However, this approach avoids annualising or truncating returns. In cases where multiple listed entities exist (e.g. the two eMedia lines), the option with the lower returns was selected.

The Capped Allshare Total Return Index was chosen as the benchmark because of its historical data availability and superior performance relative to alternative indices during the measurement periods.

Appendix

Spin-off performance relative to the JSE:

Parent company performance relative to the JSE:

Stratified spin-off performance relative to the JSE:

Very interesting read, thanks Richard